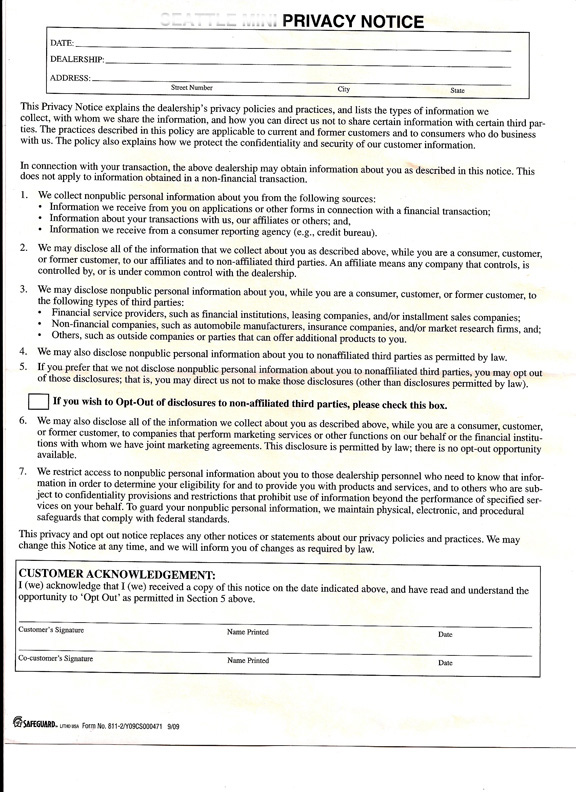

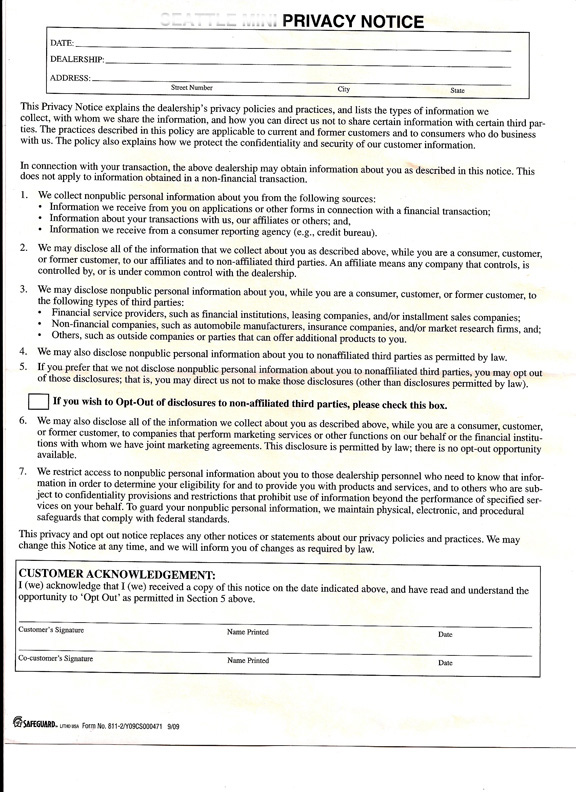

| Take a look at this so-called "opt out" document presented to me online or in person when I was considering leasing a Volvo, a Toyota or a Mini Cooper. In each case, all three dealers were using the same form. I found that peculiar in itself. As you read the form, what tricks are being played on the consumer? Can you identify any semantic games being played to confuse and deceive?

For an online version of this document with a bit more clarity, go to the Volvo Dealer's site.

The only information sharing that a customer can opt out of is sharing with "non-affiliated third parties" as stated in clause #5. With this document, all other sharing with all other parties is still permitted. Clause #6 even states "This disclosure is permitted by law; there is no opt-out opportunity available."

The automobile companies should only have the right to gather this information to check whether the customer is credit worthy, but they have invented a side business selling that information to interested "aligned" third parties and partners. Isn't this a form a identity theft?

As you read the form, what tricks are being played on the consumer? Can you identify any semantic games being played to confuse and deceive? What kinds of questioning skills are needed to understand the true impact of this document?

After Comprehension Comes Synthesis

We not only teach our students to ask good questions while reading the fine print, we also show them the power of synthesis. Faced with a mortgage or credit agreement that is unfair to consumers, we would expect them to redraft the document so that their rights are protected and the agreement is fair.

Faced with a so-called "Opt Out" document that did not allow me to opt out, I drafted an agreement that would permit the dealer and its partners access to my financial records for the sole purpose of judging my credit worthiness. It is reproduced below:

Seattle Mini Privacy Agreement

The two undersigned parties, Seattle Mini and Jamieson McKenzie, hereby agree to the following conditions governing the use and sharing of financial data gathered from McKenzie to assist Seattle Mini with the task of assessing McKenzie's credit worthiness.

1. McKenzie hereby gives Seattle Mini permission to access his banking and credit records for the sole purpose of assessing McKenzie's credit worthiness.

2. Seattle Mini agrees to limit its search of financial data to only those credit reports and other financial records that are required to assess McKenzie's credit worthiness for the purpose of leasing a vehicle.

3. Seattle Mini further agrees to limit access to the financial and credit information gathered only to those affiliated business partners who must be directly involved in the financial aspects of McKenzie leasing a car from Seattle Mini.

4. Seattle Mini agrees that the information gathered may not be shared with other partners, affiliated or non-affiliated, marketing groups or any other party for any other use beyond the assessing McKenzie's credit worthiness.

5. Seattle Mini agrees to protect the privacy of McKenzie's financial information from any employee, partner, agency or group no directly involved in the limited business of leasing the car to McKenzie.

6. Seattle Mini agrees that this agreement may not be altered in any way during the purchasing process or during the term of the lease unless both McKenzie and Seattle Mini mutually agree to any such change. The privacy protection provisions in this document are permitted by law, and McKenzie is permitted to Opt-out of information sharing other than that above as is permitted by and is in compliance with Federal Standards.

Agreed to by

_________________ ........................................_______________

Jamieson McKenzie ........................................Seattle Mini

October 30, 2009

_________________ ........................................_______________

................................................................................Date

|

Whether leasing a car, buying a house, getting a credit card or negotiating a college loan, we expect our students to read the fine print and then fight for fair language. We certainly do not expect them to roll over and sign agreements that are unfair, misleading and deceitful. We hope they will not surrender their private information without even realizing they are doing so.

In the case of the Seattle Mini dealer, the deal failed and they lost a customer because they would not sign the agreement I submitted. They stuck to the "No Opt Out Opt Out" document that I refused to sign. At a time when the automobile industry is struggling to survive, I find it curious that three brands all use the same "No Opt Out Opt Out" document.

In a Time of Financial Collapse, Bad Loans, Foreclosures and Mortgage Derivatives

Emerging from several years of terrible economic conditions brought on in part by speculation and questionable lending practices, the consequences of citizens not reading agreements carefully should have become evident. Many folks signed adjustable rate mortgages without understanding the features of their ARM. They found their monthly payments suddenly escalating and many lost their homes, unable to keep up with those payments.

The Federal Reserve Board provides a Web page with an extensive list of definitions and questions to guide those who are considering an ARM. Even armed with such assistance, the reading of documents and the asking of questions is still a demanding task. There are no short cuts or easy ways to manage the process.

According to several articles in The New York Times this past year, one must even be cautious when hiring a mortgage broker to help with the process.

- When to Use a Mortgage Broker

By RON LIEBER

Published: April 3, 2009

-

- "Mortgage brokers work for themselves, not for you. They do not provide a personal shopping service and may compare only a handful of lenders on your behalf. If you want to be sure you’re getting the best rate and the lowest costs, the only way to come close to succeeding is to hunt extensively on your own."

A lack of regulation allowed some mortgage brokers to steer borrowers to banks where the brokers could expect payment for the steerage:

- "The problems in recent years, however, came when banks offered more money to brokers who pushed certain loans or terms, say loans with interest rates that rose quickly and imposed penalties if the borrower refinanced within a few years."

Lieber advises consumers considering the use of a broker to ask how they are paid. He finishes his advice column with two suggestions to reduce the risk of using a broker: 1) request a guarantee on their good faith estimate and 2) request a signed statement that they will work solely on the consumer's best interest.

Lieber's column runs parallel to my own experience with the No Opt Out Opt Out document in the sense that surrender is not really an option. Each consumer must learn to read and understand all the documents or at least find a friend who can help with the reading, someone, as Lieber puts it, "if you don’t understand the answer, run it by an accountant or a more sophisticated friend whose compensation does not depend on the answer."

|